SOUTH LAKE UNION – King County is the 13th largest county in the U.S. and has grown at the second fastest rate among large urban counties in America. And South Lake Union is a catalyst to that growth.

In a presentation to the South Lake Union community King County Assessor Lloyd Hara answered many of the questions that property owners have regarding valuations.

“One of the top questions that I am asked is ‘Are my taxes directly affected by property valuations?’ “, Hara told Tuesday's meeting of the South Lake Union Community Council at the Museum of History and Industry.

For more information visit the King County Assor's Office or to learn more about your property values in under three minutes see the presentation below.

South Lake Union Community Council

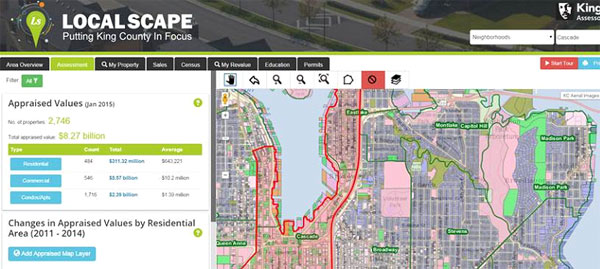

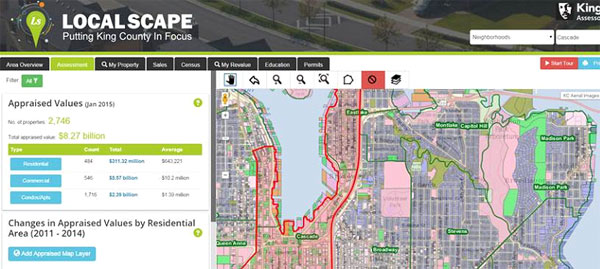

Assessors’ Office launches interactive LocalScape app which showcases property values and community trends

Thank you for having the Assessor come and speak at the South Lake Union Community Council.

https://vimeo.com/140985589

Prezi Presentation Link here

King County Assessor

Facts on Property Values

1. How does the King County Assessor’s Office determine property values, and where can I find more information?

Washington State law requires all Assessor’s to value land as vacant first, and then analyze sales and market trends of a variety of properties based on size, year built, quality of construction, and other characteristics. The 2015 property values are set as of January 1, 2015, based on sales of comparable properties in the same area.

We annually value more than 700,000 King County properties and physically inspect one-sixth of them.

Assessor Lloyd Hara is an advocate for taxpayers and for open, transparent, and accountable government. You can find all market sales in our 2015 Area Reports and should visit LocalScape to search for area sales and individual property info.

2. In this rising real estate market, will my property taxes increase at the same rate as my property valuation?

No, the Assessor’s Office sets property valuations. It does not set taxes, and there is not an automatic percentage increase correlation between your property value increase and future property taxes.

King County taxpayers who need advice and assistance with property tax related matters, including appeals, should contact the King County Tax Advisor at 206-477-1060 or by email at taxadvisor@kingcounty.gov.

There are three key factors that determine your tax rates:

3. Are there limits to how much government entities can raise property taxes?

3. Are there limits to how much government entities can raise property taxes?

Yes, local Taxing Districts (such as the county, cities, fire districts, etc.) are limited to an annual 1 percent budget increase, plus new construction value – regardless of how much property values increase or decrease.

For example, if a city receives $1 million in property taxes, it can only levy and receive $1.01 million the next year, plus revenue from new construction. The only exception occurs when voters approve measures.

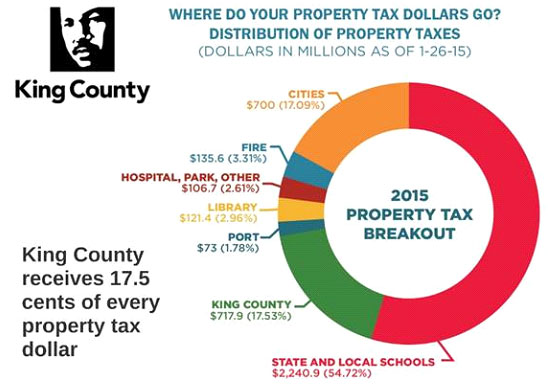

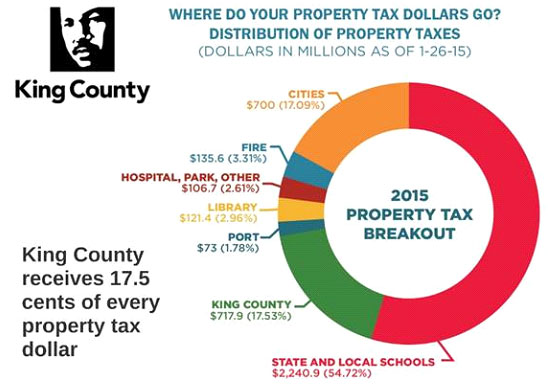

4. Who sets property taxes, and how are property tax dollars allocated?

The Assessor does NOT set property taxes. Each year, property taxes are determined by a combination of your state and local government (schools, roads, parks, libraries, hospitals, city and county government), and your local Taxing Districts such as ports, fire districts, utility and sewer districts.

The King County Treasury’s Office, NOT the Assessor, is responsible for collecting and distributing property tax revenue to state and local governments. In 2015, King County received 17.5 cents of every property tax dollar.

King County taxpayers, who need advice and assistance with property tax related matters, should contact the King County Tax Advisor at 206-263-9700 or by email at taxadvisor@kingcounty.gov.

5. How do I request more information about the value placed on my property?

Property owners with questions for the Assessor’s Office should contact us at 206-296-7300 or email assessor.info@kingcounty.gov. If you feel we have made an error in the characteristics of your property, you can request that the data be reviewed or explained by an appraiser and an Assessment Review can be initiated.

6. How do I appeal the value of my property?

Appeals are filed with an independent agency of King County – the Board of Equalization. The Board is made up of citizens who are not employees of King County and who are appointed by the King County Executive and confirmed by the King County Council. The goal of most appeals is to prove that the assessed value exceeds the fair market value as of January 1 of the assessment year and provide sufficient evidence for the Board to determine what the most probable fair market value is. The Board’s determination of fair market value can be more than, less than, or equal to the original assessed value.

Visit http://www.kingcounty.gov/appeals for additional information about the appeal process and for the resources to file either on-line using eAppeals or by paper using the downloadable forms.

7. What exemptions are available for qualified seniors, veterans, and disabled property owners?

The Washington State Legislature passed Senate Bill 5186, which increased the qualifying income from $35,000 annual gross income to $40,000 for the senior/disability property tax exemption.

This income change is not retroactive and will be applied to 2016 property taxes and subsequent years.

The King County Assessor’s Office administers this exemption program for low-income seniors (61 years of age or older) and property owners with disabilities. Depending on your income, you may be eligible to receive a standard, partial, or full exemption. In addition, the value of your home will be frozen at the valuation of the initial application year and any property tax reduction does not have to be repaid upon transfer of ownership.

To check your eligibility or for more information, contact the Assessor’s Office at 206.296.3920 or visit www.kingcounty.gov/depts/assessor/Forms.aspx.

Senate Bill 5186 also raised the income limit from $40,000 to $45,000 for the deferral program, which delays property taxes for seniors and the disabled until a later date. Under the deferral program, the Washington State Department of Revenue pays the property taxes and any special assessments on the property owner’s behalf. The deferred amount, plus interest, becomes a lien on the home until the total amount is repaid.

To be eligible, the homeowner must be either at least 60 years old, unable to work because of a disability, or be at least 57 years old and the surviving spouse or partner of someone who was receiving a deferral at the time of death.

SOUTH LAKE UNION – Longtime Seattle resident Matthew Curry has been appointed to the board of directors of the South Lake Union Community Council.

A stakeholder in the rapidly developing South Lake Union neighborhood, Curry has worked as Research and Operation Manager for University of Washington Medicine at South Lake Union since 2007. He has a strong history of community service including participation with the Community Council’s Policy and Planning Committee, board leadership with the

SOUTH LAKE UNION – Longtime Seattle resident Matthew Curry has been appointed to the board of directors of the South Lake Union Community Council.

A stakeholder in the rapidly developing South Lake Union neighborhood, Curry has worked as Research and Operation Manager for University of Washington Medicine at South Lake Union since 2007. He has a strong history of community service including participation with the Community Council’s Policy and Planning Committee, board leadership with the

3. Are there limits to how much government entities can raise property taxes?

3. Are there limits to how much government entities can raise property taxes?

SOUTH LAKE UNION –

SOUTH LAKE UNION –